LOS LUNAS — You don’t know when, you probably don’t know how and you more than likely don’t want it to happen. However, everyone’s fate is the same — we all will one day die.

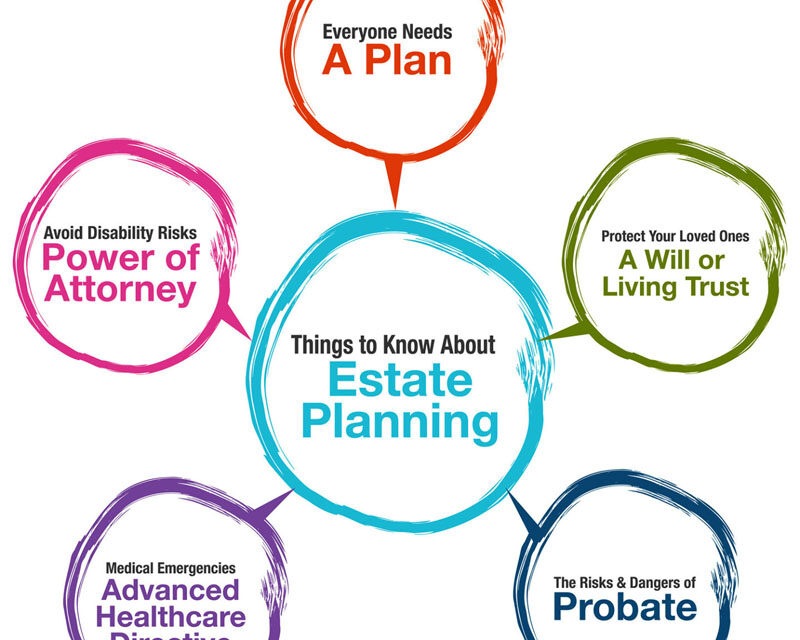

When that time comes, it’s important that your loved ones know your wishes and can rely on your estate plan to guide them through their grief. Estate planning can help you properly prepare you and your loved ones for when that fateful day comes — and it will.

Yvonne Sanchez, co-owner and a financial advisor at Rio Grande Financial Network in Los Lunas, and with Cetera Financial Group, says having an estate plan in place will give everyone peace of mind.

Clara Garcia | News-Bulletin photo

Yvonne Sanchez, co-owner and a financial advisor at Rio Grande Financial Network in Los Lunas, and with Cetera Financial Group, says having an estate plan is something everyone should have, regardless of their financial standing.

“The first step is sitting down and taking an inventory of your assets, and making sure everything is registered right and set up right,” Sanchez said. “Meaning, you can set up a trust or just title your assets where they’re going to be directed to your beneficiaries. So you can do what’s called a transfer on death.”

Sanchez says taking an inventory of all your assets is the first step in estate planning. She says everyone has an estate, whether they believe it or not.

A modest home, a beat-up truck and a bank account with $500 in it is as much as an estate as one with a $1 million home, a fleet of cars and an investment portfolio.

An estate can also include jewelry, collections, artwork, musical equipment, furniture and more.

“When people are talking about estate planning, it’s also about legacy planning and what you want to leave your heirs or even to a charitable organization,” Sanchez said. “It’s inevitable. No one can avoid death and taxes, and we all have to deal with it and plan for it.”

Having been a financial planner for the past 20 years, Sanchez said few people want to talk about it much less plan for the inevitable.

“If I can get my clients to deal with it up front, and once they have done their estate planning, they feel so much better,” she said. “They feel they have that peace of mind that when they pass away, things will be taken care of as they wanted.”

Sanchez said she’s seen too many families fight over assets when their loved ones pass away, and that’s something that could have be avoided if only an estate plan was in place. It’s one thing to tell your loved ones what you want to happen after your death, but it could end up in turmoil if those wishes aren’t written down and documented.

An estate plan can include directions for any medical issues you may face, as well as establishing financial directives while you’re still alive — and after you’re dead.

“It’s such an emotional time when someone passes away, and if someone in the family is hit with a surprise, it might not turn out so well,” Sanchez said. “If you don’t create an estate plan, it might just create conflicts when one passes away. The more that everyone knows what’s going on, the better and it makes things a lot easier.”

Sanchez said every case is different, and depending on your situation, you can title your assets, such as a transfer on death. A transfer on death automatically transfers assets to a named beneficiary when someone dies. For example, if you have a savings account and you name your son as its beneficiary, that account will transfer to him upon your death.

The same can apply to other accounts, such as investments, vehicles and real estate.

“You can have a will, too, but if you title your assets with a beneficiary designation, you’ll still have to go through probate court,” Sanchez said.

She also suggests if you want a portion of your estate to go to a charitable organization, you need to make sure you set that up as well in your estate plan.

Another part to estate planning is dealing with final expenses to include your funeral arrangements. Sanchez advises her clients to prepare for their funeral by choosing the funeral home they want to use, where they want their services to be held and more.

“You just want to eliminate any sort of conflict; it’s stressful enough,” she said. “If you get everything taken care of, it’s going to make things so much easier.”

Advance planning or pre-funding your funeral can be an important part of estate planning. A lot of funeral homes offer these services, and it lets your family clearly know your wishes.

Sanchez says she advises everyone and anyone to have an estate plan, even if you’re just out of college and in your first job.

“Even if you’re not married, you still need to take care of your assets,” she said. “If you don’t have any beneficiaries, where do you want your assets to go to? Your niece or your nephew? Your parents?”

There is no better time than now to start your estate plan, Sanchez said. It’s also a good idea to review it on an annual basis, in case something has changed, such as buying or selling property, if you’ve had a death in your family or even if you’ve started a 401k at your new job.

“Also, make sure you let people know what you’ve done,” she said. “If you’re dealing with a financial advisor, your tax person, your lawyer and your beneficiary, you should let them know what’s changed and what you’re doing.”

A lot of people put off estate planning, but Sanchez says everyone can benefit from having one. Knowing you have a plan in place — one that contains your instructions and will protect your family — will give you and your family peace of mind.

Clara Garcia is the editor and publisher of the Valencia County News-Bulletin.

She is a native of the city of Belen, beginning her journalism career at the News-Bulletin in 1998 as the crime and courts reporter. During her time at the paper, Clara has won numerous awards for her writing, photography and typography and design both from the National Newspaper Association and the New Mexico Press Association.