What if you could settle a lawsuit for a debt or money due without setting foot in a courtroom?

Last month, the New Mexico Courts implemented an online service for resolving debt collection lawsuits. Online Dispute Resolution is a free service which allows both sides in a lawsuit to negotiate an agreement through private online messages from a home, business or any location with internet access.

The system works on computers, smartphones and other mobile devices, and is available 24 hours a day, seven days a week.

“There is no need to appear at a court hearing for the parties in a consumer debt case who successfully reach a settlement with Online Dispute Resolution,” wrote 13th Judicial District Court Chief Judge Louis McDonald in a recent press release. “It can take months, and sometimes longer, to resolve a civil lawsuit.

“The new online service from our courts costs less and is much faster than going to trial to resolve a dispute over unpaid bills.”

The ODR system works somewhat like online tax preparation software, said Barry Massey, the public information officer for the New Mexico Administrative Office of the Courts.

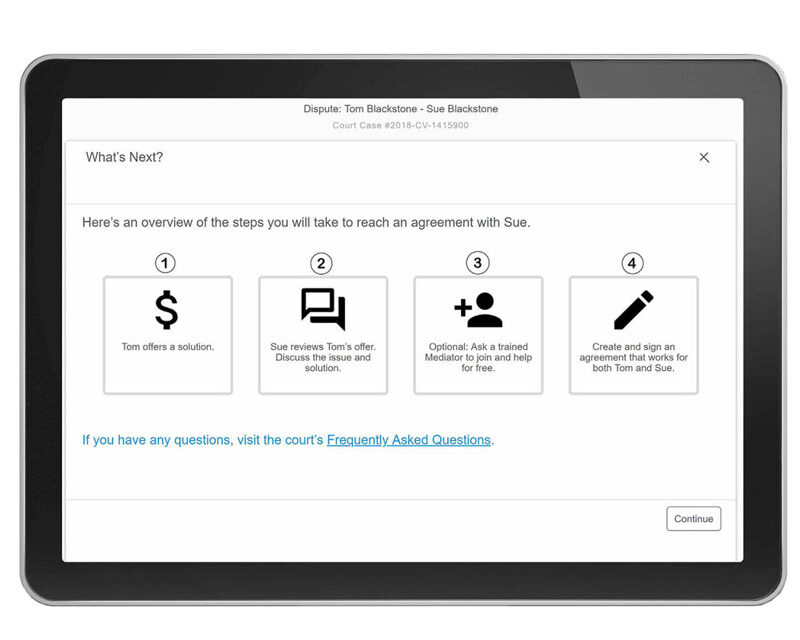

For example, the ODR system, which is strictly voluntary, will ask questions of the individual or business bringing the lawsuit about what they would accept to settle the dispute. The individual answers the questions and hits submit.

The system takes the information and sends a message to the person who was sued, and similarly asks questions about whether the individual would accept the offer, wants to make a counteroffer and/or develop a payment plan.

That person’s offer is then sent back to the plaintiff. That back and forth can continue depending on the parties’ answers and their willingness to negotiate.

If an agreement is reached the system will automatically prepare a settlement document and electronically file it in court.

For those without a computer or internet access, the ODR system could be used at a public library that provides computer access.

The parties also can ask an online mediator to help them bridge their differences during the first two weeks of negotiations.

The ODR opportunity lasts for 30 days and will then move to court if no settlement is reached. The parties can opt out of ODR at the outset of a lawsuit or at any time during their online negotiations.

If the resolution process isn’t successful and the case goes forward to a judge, the judge and court do not see the information shared between the two parties, Massey said via email.

“The court would not know from ODR, for example, that one party offered to settle for a certain amount, an amount less than the full debt, for example,” Massey wrote.

Debt money due cases can be instances such as where a bank sues a person over credit card debt or a hospital seeks payment for unpaid medical bills. These types of lawsuits can also include two private citizens.

About 31,000 debt and money due lawsuits were filed statewide from April 2018 through April 2019, according to a recent press release form the courts.

While the courts are most often associated with criminal cases, in New Mexico, civil cases, such as debt or money due, account for about three-fourths of the cases in district courts.

Courts are also seeing an increasing number of people who represent themselves in civil cases. In the 2018 fiscal year, about 51 percent of all newly-filed civil cases had at least one of the parties not represented by an attorney, an increase of 36 percent from the 2011 fiscal year.

The ODR system was launched as a pilot program in the 2nd, 6th and 9th judicial districts in June, and went state wide on Sept. 1 to all district and magistrate courts.

To learn more about the free online service, visit the ODR website of New Mexico Courts, nmcourts.gov/ODR.aspx.

Julia M. Dendinger began working at the VCNB in 2006. She covers Valencia County government, Belen Consolidated Schools and the village of Bosque Farms. She is a member of the Society of Professional Journalists Rio Grande chapter’s board of directors.